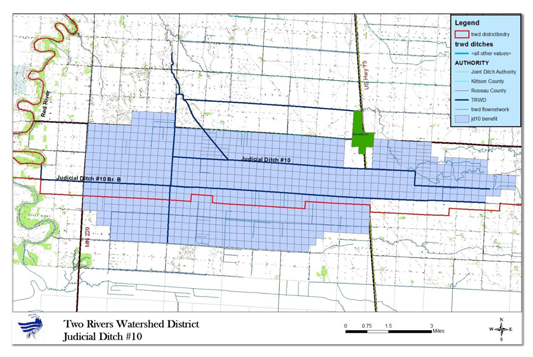

Judicial Ditch #10

About Judicial Ditch #10

Miles: 31

Township(s)/County: Davis, Svea, Teien, and Kittson

Ditch Balance: -$47,795

2024 Levy: $0

Future Maintenance: Survey 2024, Possible cattail spraying. Petition for Improvement received; Possible construction 2025-2026

This system has two separate branches, which are a combined length of approximately 31 miles. The main branch begins near the west half mile line in section 36 of Davis Township and flows west through the center of sections 35, 34, then turns north for a half mile at the center of section 33 until it reaches the north half mile line then proceeds west through sections 32, and 31. Continuing through sections 36, 35, 34, and 33 of Svea Township, then, at the northwest corner of section 33, JD #10 flows northwesterly cutting across section 29, 19, and 18 of Svea Township and sections 13 of Teien Township until its outlet into a coulee in section 12 of Teien. JD #10 "Branch B" flows westerly along the Kittson-Marshall County line beginning in the southeast corner of section 35 of Davis through section 34 then along the northern boundary of sections 4, 5, and 6 of Sinnott Township in Marshall County, sections 1, 2, 3, 4, 5, and 6 of Donnelly Township, and sections 1, 2, 3, and 4 of Eagle Point Township turning north at the half mile line in section 5 where it continues north and outlets in section 33 of Teien into the Red River of the North. Branch B is approximately 16 miles long. There is also a small lateral of JD #10 beginning in section 32 of Svea that flows west and joins JD #3 at the northwest corner of section 31.

This system isinspected annually and

maintenance activities are undertaken if deemed

necessary. These activities range from beaver dam removal and beaver trapping to spraying of cattail and

other nuisance vegetation to removal of silt and sediment to repair of sloughed side slopes or eroded

culverts. Detailed maintenance reports are kept and filed each year in the ditch file.

The District as the ditch authority for these ditches is also responsible for maintaining a ditch fund to pay

for maintenance expenses. Each year the District assesses

the needs of each ditch and a tax is levied

against the "benefited area" of each ditch, if necessary and if the funding is needed. Each year the

District certifies this levy to the County Auditor of the County where the ditch is located.